Learn thanks to this article in detail, if I work abroad, do I have to do the income tax return? Discover it here!

If I work abroad I have to do the income tax return

One of the most recurrent doubts that occurs to people who have emigrated from their country of origin is If I work abroad, do I have to file an income tax return? To resolve this question, the first thing we must do is clarify our legal situation within the territory, in this case Spanish, to avoid government sanctions that affect our stay within the country.

In Spain we must take into account that if we are foreigners we can run the risk of paying double taxation for this status. However, we must be very careful with the tax systems of the countries where we reside.

In Spain specifically we must determine if we are tax residents or not. This is the first step to correctly determine our payment or declaration of income within this country, which in recent years has been home to many countries in economic or cultural difficulties.

In order to determine if we are Spanish tax residents, we must take into consideration different characteristics that make us viable subjects to make these declarations. Among which we find:

- Length of stay: to qualify as tax residents of the Spanish government we must live more than one hundred and eighty-three days of the year in Spain.

- Economic activities: Another of the fundamental characteristics that defines us if I work abroad I have to make the income statement, is to have our direct or indirect economic systems within Spain.

- Economic dependence: finally if our spouse or children who are minors reside in Spain.

If we meet these three characteristics, we are tax residents before the Spanish Treasury, so the answer to the question: If I work abroad, do I have to make the income statement? It is positive and we must comply with the different tax obligations handled by the Spanish government.

Avoid double taxation of income

If I work abroad I have to do the income tax return and we want to avoid double taxation because I am not Spanish by birth. Double taxation occurs when the government withholds money from us for work performance in the other country where you were living.

This means that if we do not clarify our fiscal situation before the government or the Treasury, we can end up paying taxes in both countries for the same income. We can arrange this process quickly, presenting the fiscal forms that are requested in order to cover the income of the corresponding countries and pay for the portion that is described.

One of the many advantages that Spain offers us for the income statement is the option of agreements both in the European Union and in most of South America, which allows us to expand our income statement range and comply with our tax obligations.

Therefore, it is necessary to understand that if I work abroad I have to make the income tax return, it does not exempt us from the declaration and payment of tax in the other country of residence. Let us remember that no matter how much money we have, it can be salary, dividends, rental of movable or immovable property, we must make the income statement to the Spanish Treasury to avoid sanctions.

To understand this concept more clearly, we leave you the following video

Income tax with foreign income

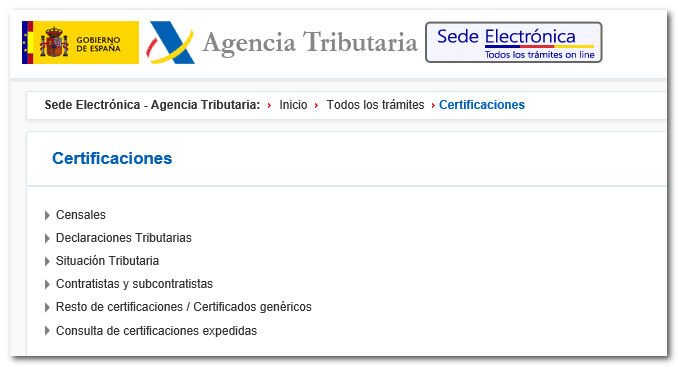

We have already determined that if I work abroad I have to make the income statement. And to do this, in the first place, we must request the form and IRPF from the Treasury, which is a format that requires us to provide information to determine the payment of the rent that must be made. When we request this form, if we are not sure that the Spanish government has a double taxation agreement, we recommend that you request the list of countries with which this treaty exists.

The process to request and obtain the different income forms under the support of the IRPF and the draft of the same, we find that they do not generate any change, but on the contrary, it allows us to evaluate in a complete and decisive way the application of a tax exemption. the IRPF form for the income that we have obtained outside of Spanish territory.

When we are understanding the fiscal modality of any country, it is important to read and get advice to handle complete and valid information that covers any doubt we may have. In this order of ideas, we find that article 7P of the personal income tax law specifies that workers abroad can take advantage of the income exemption as long as it is less than sixty thousand one hundred euros. In order to be eligible for this exemption, we must meet the following requirements:

- The company with which we have an employment relationship abroad cannot be a resident of Spain. If this is the case, we can only work in a store, establishment or branch that is outside the country (Spain).

- The country where we work abroad must handle characteristics similar to those stipulated in the IRPF and the country cannot be considered a tax haven.

If we manage to meet these requirements, we can be full candidates for the exemption. If I work abroad, I have to make the income statement, so we can benefit from these regimes without any problem in order to avoid paying for work that we do outside Spanish territory.

IRPF reviews of the companies where we work

Let us remember that lying or falsifying information to the Treasury places us in a position where we can run the risk that the Treasury will take fiscal action against us or against the company where we develop them.

If we declare that our organization gives us less than sixty thousand euros a year, it is an alarm that goes off since they are extremely low averages for workers in the Spanish sector.

That is why it is recommended that the organizations where we operate make withholdings that go directly to the personal income tax account in order to maintain these cases without total displacement.

Applying these exemptions if I work abroad and have to make the income statement, allows us to demonstrate truthfully and completely that we are totally subject to protection under article 7P of the IRPF law without entering into tax crimes, as long as when our income sheet and CIRBE is completely and truthfully updated. If you want to know what this is, we invite you to enter the following link What is Cirbe?

The second alternative that we can use is to pass each of our income and make the income statement without using the exemption and then challenge the compensation of the tax paid in excess for not having enjoyed this benefit before the Spanish Treasury. This translates into the presentation of the corrective form of the declaration which we can present invoking errors or introducing the exemption so that there is evidence of our declaration and payment abroad.

The important thing is that we always seek to be within the normal legal, fiscal and tax regulations regardless of the country where we are in order to avoid sanctions, fines or extraditions for breach of law or contempt of the authorities.