Next, we will explain how how to fill model 600, we will also describe what it is for and what its usefulness is, learn more about this topic by reading the following article.

How to fill in the 600 form?

Sometimes we can waste a lot of time trying to fill out this form, not knowing the lines or not being familiar with the filling process. Multiple formats and time may be lost. That is why in this article we will explain how to fill in the 600 model in a simple and easy way.

Our purpose is to try not to waste time and easily go to the lines where they are the most important according to your needs. So let's start at once with the explanation of the filling.

Also know through the following link the meaning of the Property transfer tax

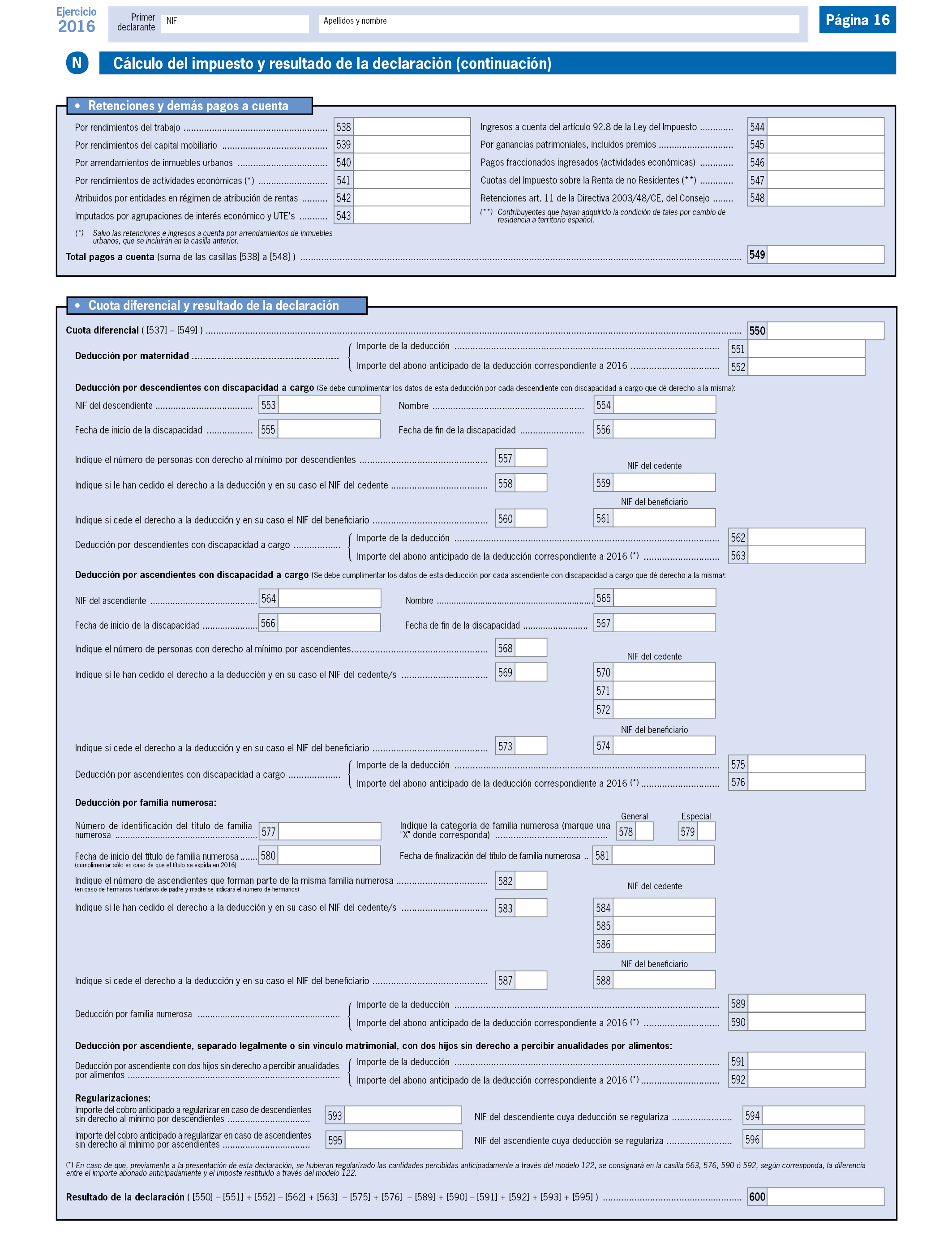

The first thing you must do is fill in the line where the tax is established, then the date of operation and the date of presentation. In the case related to specific situations, another line must be filled in, which we will detail later.

identify the subject

Put first the data of the taxpayer (Buyer) and also those of the seller in this case it is called the transferor. Do not leave any space blank, locate the residence data, contact telephone number. In model 600 there is the figure of presenter which is considered to be the person who physically presents the document.

You must also enter the data of the presenter, generally it is the taxpayer. In case it was another person or a management company, the data to be filled will be those required in the format, also do not leave this space blank.

Document Data

In this part you must indicate what type of document is being processed, select if the document is administrative, judicial, commercial or private. Depending on the type of document, it is important to fill in the data of the notary, the administrative judicial authority and the municipality to which it belongs.

Data of the goods

This section serves to describe the type of good, operation or act to be carried out. In the case of purchasing a home, you must fill in everything related to the address, the type of location if it is rural or urban, the declared value. In this case, enter the amount that appears on the IBI receipt and the cadastral reference.

self-assessment

The data of the action to be carried out must be included, the amount of the taxes must be entered. Likewise, the value of the good must be filled in, except for the tax discount.

Base of ITP/AJD

This amount is calculated taking into account the type of tax that is applied to the base, as well as the deductions and bonuses that are applied to the fee. The taxes and their deductions are in a band that goes between 0,5% and 8% depending on the operation that is going to be carried out.

Tax calculation

It is obtained by subtracting the tax which depends on the type, bonuses and deductions. In the case of the existence of surcharges or interest on arrears, they must be added to the result.

The Firm

It is the final part of how to fill out the 600 form, the presentation data of the model and the seller's signature must be placed, as well as the form of payment

The 600 models are unique and must be filled in only when there is no other model or different action to declare. However, for the purchase of a vehicle, form 620 must be used. While for the purchase of a home, form 600 must be filled out.

What is the 600 model?

Model 600 is a format established by the Spanish Tax Agency that is used to cancel and settle the ITP, Property Transfer Tax and Documented Legal Acts (IAJD). It is specifically designed when the contract of sale of a house or residential property is made.

If you are in the process of buying or acquiring a home, it is important that you know how to fill out form 600. The idea is to know what types of collections and what data should be entered so as not to have to waste time later.

What is it used for?

This model is used primarily to carry out corporate operations, such as the increase and reduction of capital, as well as the constitution or dissolution of companies. In other cases for the liquidation of mortgages it is established in the legal acts of onerous patrimonial transfers.

Likewise, this format is used for the sale of housing, rent, mortgage cancellation and loans to relatives. We recommend you read the following article related to shared mortgage, where you will learn more about this type of situation.

In the same way, it is used to carry out documented legal acts, including notarial, commercial and administrative documents. Each one of them allows us to consider this format or model 600 as one of the most practical in tax matters.

Where should it be presented?

After the payment of the ITP is made, there is a period of thirty days to file the return and pay the respective amount. If the act is related to the sale of a home, the term begins from the date of signing the deed.

If the return is not filed within the agreed period, the tax system has sanction measures for those who violate this act. On the other hand, the form can be submitted online. Making the payment through a bank transfer or credit card payment.

The person can also go to the nearest treasury delegation settlement offices after having made the payment at the bank. If the activity for some reason is exempt from paying the tax, form 600 is filled out and delivered to the nearest tax agency.

Recommendations

When you decide to carry out an act typified in this type of format, it is always good to remind yourself and review the entire model 600 in detail. Try to check each line first and don't start filling in without being sure.

Remember that if you omit any information, make a mistake and then introduce the document for processing, this can cause problems of delay and even the application of sanctions. For no reason invent the data, place only what is requested, especially if the sale process is in progress.

Locate a quiet place where there are no people or movement of people. Use one pen and have another one just in case the one you are using gets damaged or runs out of ink. Focus only on filling the model. Have at hand the additional documents that will allow you to know how to fill out form 600.

If you have any doubts, ask the officials who are available, for no reason ask other people, sometimes the remedy can be worse than the disease, committing or omitting some data, also placing unnecessary information.