How to endorse a check, is an issue that many will not give the importance it deserves, however, it is something that must be done correctly, without errors or erasures, otherwise the accounting document will be unusable. Learn about the necessary steps in this article.

How does endorse a check?

To learn how to endorse a check correctly, first we are going to tell you what this term of endorsing means, it refers to placing the signature and data on the back of the accounting document, and with this transfers a check, a promissory note, in favor of another holder. a bill of exchange or any other security.

The process of how to endorse a check correctly is very easy, it does not require great efforts, just be extremely careful to place the correct data without crossing out or amending, otherwise it disables the document.

It is important that users know the data requested by banking institutions, where many types of transactions can be made, such as: currency exchange, cash withdrawal, service payments, check collection, and many others.

Being one of the most common to attend these institutions with a check to change it, or to deposit it in an account in your favor, or in favor of another beneficiary. This is a safe and effective management, when it is the case that people do not want to carry money in their pockets and avoid any inconvenience.

Among the most frequent operations is to endorse a check that can occur for two reasons: to be cashed by a beneficiary other than the one that appears in the accounting document, or deposit it to the account in favor of a user other than the one that appears on the check.

We invite you to know in this article How to deposit in paypal

Steps on how to endorse a check

The first step to endorse a check, in principle for another person to cash the check and the bank to deliver the cash, is for the beneficiary to assign the rights to the document.

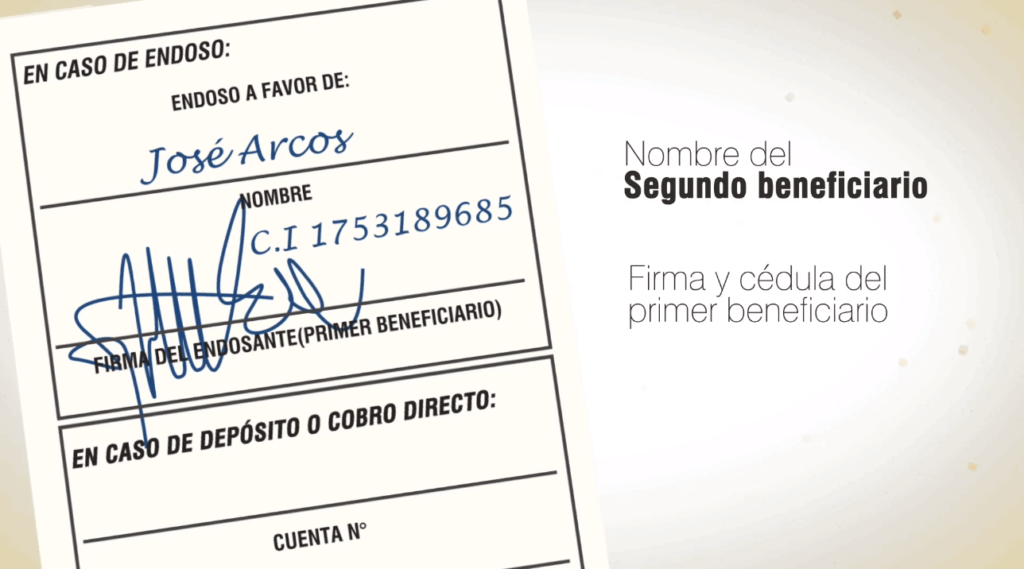

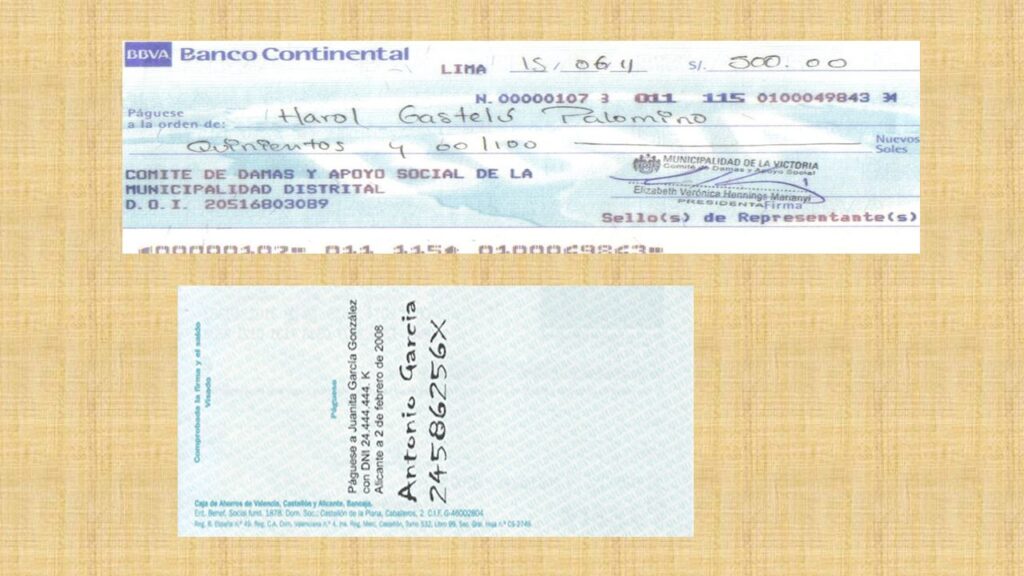

Then, the beneficiary must take the document and write on the back or on the reverse, a clear and legible phrase without erasures that says: "Pay to the order of...", or failing that, "I assign the rights to... :” Likewise, you must enter the name of the person who will cash the check; once the original beneficiary who wrote these data, he must place his signature on the document.

It is also important that the document contains the address of the person to whom the check was endorsed, among which your INE password will appear, this is in case you attend to cash the check without identification, something that should not happen.

Certain banking institutions, within their policies and regulations, request a copy of identification in order to make the payment of the document effective, so it is important to request information from the corresponding banking institution before going to the bank.

Endorsed check to be deposited in another payee's bank account

The process of endorsing a check is similar to the case indicated in the previous paragraph, with the distinction that the person who receives the endorsement will not receive the money in cash, but rather it will only be deposited in his or her personal bank account, so it is necessary to provide the bank account number, which must be placed on the back of the document.

The beneficiary must write on the back of the check the legible name of the other person, who becomes the new beneficiary, and affix his/her signature. You can add other additional data of the new beneficiary such as your ID; It is important to make it known that legal entities are also free to endorse checks, as a requirement they must include the following: "by proxy" or "pp" writing the name of the company.

On many occasions, and depending on the bank account where the beneficiary deposits the check, it may be made effective immediately, but since it involves deposits from accounts of different banking institutions, the deposit is made effective after 24 hours.

Many banking institutions charge a percentage as a commission for this type of financial transaction, especially when the check is deposited from one institution to another. In these cases, the user will verify if he agrees to pay, or failing that, he can cash the check.

There are some cases where the endorsement is made only with the signature of the beneficiary that originally appears on the accounting document. In this case, it is recommended that the beneficiary do it safely once he is going to collect it, if it were the case that he lost the endorsement data, anyone can collect it.