Today we will teach you through this interesting article everything you need to know about the main Characteristics of the Colombian economy. How your products are managed based on it and its function today. Do not miss it!

Characteristics of the Colombian economy

The economy of this country has an upper-middle income. It stands out internationally for the significant growth it has developed in the last decade in product exports and the attractiveness it offers to foreign investment.

It is the fourth largest economy in Latin America, after those of Brazil, Mexico and Argentina. In the international ranking with more than 50 million inhabitants, it is among the 30 largest in the world.

We can say that since the 50s of the XNUMXth century and even the previous decade, Colombia's main means of obtaining foreign exchange focused mainly on foreign sales of coffee.

However, several sectors have made this nation one of the most recognized countries for its production, such as emeralds and floriculture.

It also highlights the automotive and textile industries and is a major exporter of gold, sapphires and diamonds, among other products.

The country participates in several international organizations and communities that seek cooperation and consolidation of economic development actions.

Globally, it is part of the World Trade Organization (WTO), the Organization for Economic Cooperation and Development (OECD) and the CIVETS block of emerging countries (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa) .

At a continental level, it is a member of organizations such as the Inter-American Development Bank (IDB), the Andean Community of Nations (CAN), the Union of South American Nations (UNASUR) and, recently, the Pacific Alliance.

History

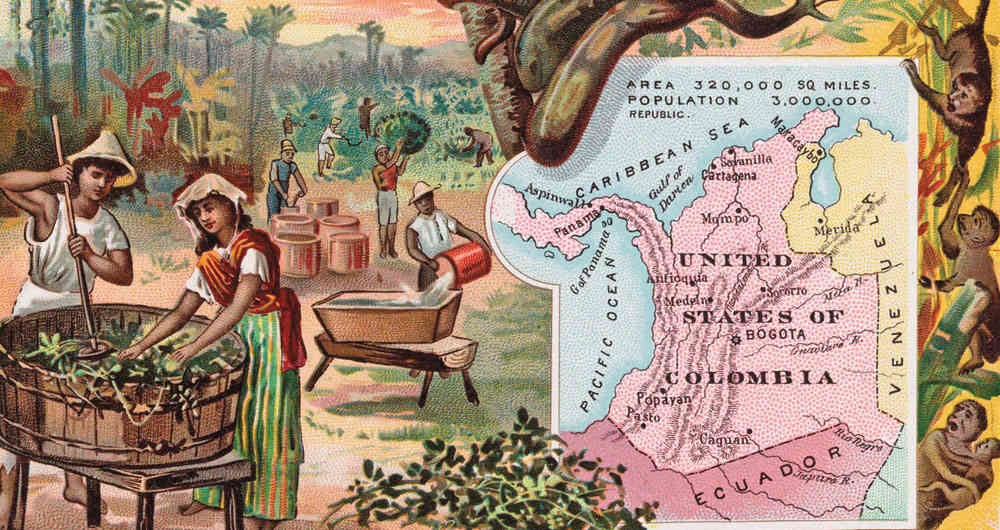

Pre-Latin American period: Commercial agriculture was the most important productive activity in the pre-Hispanic economy. Other activities that were also important in the pre-Hispanic economy in Colombia were the exploitation of mineral deposits (especially gold and salt) and the production of textiles, ceramics and articles by goldsmiths.

The possession and work of the land, such as exploitation of mines, whether of a collective nature or of society, does not apply the concept of private property in these cases. In pre-Latin American societies in Colombia there was no currency, so surplus production was exchanged through barter.

Colonial period: The colonial economic period was marked by dependence on the orders of the Spanish metropolis due to its status as a colony. Unlike the pre-Columbian period of Colombia, the exchange in the colony acquired a commercial and monetary character.

With an estimated population of 938,580 inhabitants, GDP per capita in the Viceroyalty of New Granada is estimated to have been 27 silver pesos in the year 1800. One silver peso is equivalent to 11.25 US dollars since 1985., 83 US dollars 2019.

In the last decade of his rule (1800-1810), the Crown's income was equivalent to approximately 10% of the GDP of the Viceroyalty, reaching an average of 2.4 million silver pesos per year, of which around 770,000 ( 32 ) %) came from tobacco and cognac tobacconists.

The gold mined in the provinces of Popayán and Antioquia became 85% of New Granada's exports and although the Spanish rulers encouraged free trade between the viceroys, they never managed to consolidate it.

The Crown tried to limit the power of the consulates or merchant guilds in Cádiz and Seville over trade with the metropolis and that of the consulate in Cartagena over the distribution of goods abroad within the colony, but it did not promote an opening or propitiation complete to increase competition.

However, in what was the period the viceroyalty of New Granada achieved a notable economic boost in the mid-eighteenth century, which was interrupted from 1808 with the collapse of Spain due to the invasion and the war against Napoleon's forces.

Growth has turned negative due to the interruption of trade, the bloody wars of independence, the decline of slavery, and the stagnation of international trade.

From independence to the end of the XNUMXth century

Independence gave way to a costly process of political instability, although they began a series of reforms that began to modernize the economy of the new republic.

For Colombia, the XNUMXth century was marked by a slow transition towards world capitalism, subject to the conditions and provision of opportunities offered by the development of capitalism in the industrialized countries of the North Atlantic, the growth in demand for primary products and the capital flow.

After independence, the struggle between free traders and protectionists spawned nine civil wars. During this period, there were no fundamental changes in the structure of land ownership in the country, slaves or manorial estates. having persisted, at least until the middle of the century in terms of slavery.

The republican degradation contrasts with a period of colonial prosperity between 1750 and 1808. Thus, until 1845 the national economy contracted as a result of wars, territorial and institutional disorder, and the collapse of the Spanish commercial order.

On the other hand, the external debt began in 1820, when Vice President Francisco Antonio Zea signed an agreement with the British, recognizing the obligations contracted during the period of independence, in particular by Luis López Méndez. Zea then took out another loan of £2 million, mainly for payment of outstanding debt.

However, in view of the difficult budget situation, the government contracted a new loan in 1824 that did not prevent a new budget crisis from occurring two years later, due to the defense budget and weak tax revenues. After taking out these loans, Colombia practically lost access to the international capital market for the rest of the century.

Likewise, unequal trade patterns prevail for the country. More products arrived from abroad than Colombia could sell in other countries. Throughout the century, the country imported a wide variety of products, but the low prices of cotton textiles made them the country's most important import branch at the time.

In this context, between 1850 and 1880, the United Kingdom supplied around 50% of the goods imported into the country, while France contributed 25%. For much of this century, the country attempted to integrate into the world economy by exporting gold, tobacco, cinchona, cotton, and indigo.

However, the cycles of economic expansion of these products were short and the income generated by them was insufficient, so they did not reach the established objective. Therefore, gold, which had been the main export product during the colony, remained the most important export product until the middle of the century.

For its part, the rise of tobacco as the main export product went through a cycle that lasted from 1854 to 1876, when its exports were reduced and never recovered. Then the indigo boom around 1870 lasted less than a decade and quinine became the main export product in the 1880s but declined rapidly.

In the midst of institutional instability, the historical dispute between merchants and artisans was resolved in the Civil War of 1854, in which the ship was defeated, after an alliance between a liberal group and the Conservative Party.

This war reflects the tensions between the nascent manufacturing industry and the import merchants, which develop in parallel with a process of expansion of the agricultural frontiers, embodied by phenomena such as the colonization of Antioquia and the development of infrastructure.

At this point, the Magdalena River became the center of the transportation system through which imported goods and export agricultural products entered and left the Atlantic ports of Cartagena de Indias and Barranquilla (Sabanilla), in a system dependent on of 'a single route in which sections of railway and road were joined.

As for per capita income, it increased about 20% between 1850 and 1880, at a rate of 0,5% per year. During the same period, exports increased from 3 to 20 million gold pesos. , but stagnated until the end of the century and the economy contracted again.

At that time, the external debt balance was 15 million gold pesos (about three million dollars, or 6,000 million Colombian pesos). Foreign loans in 1898 and 1899 were intended to finance the conversion of paper money into gold-backed notes.

The "coffee takeoff" (1900-1928)

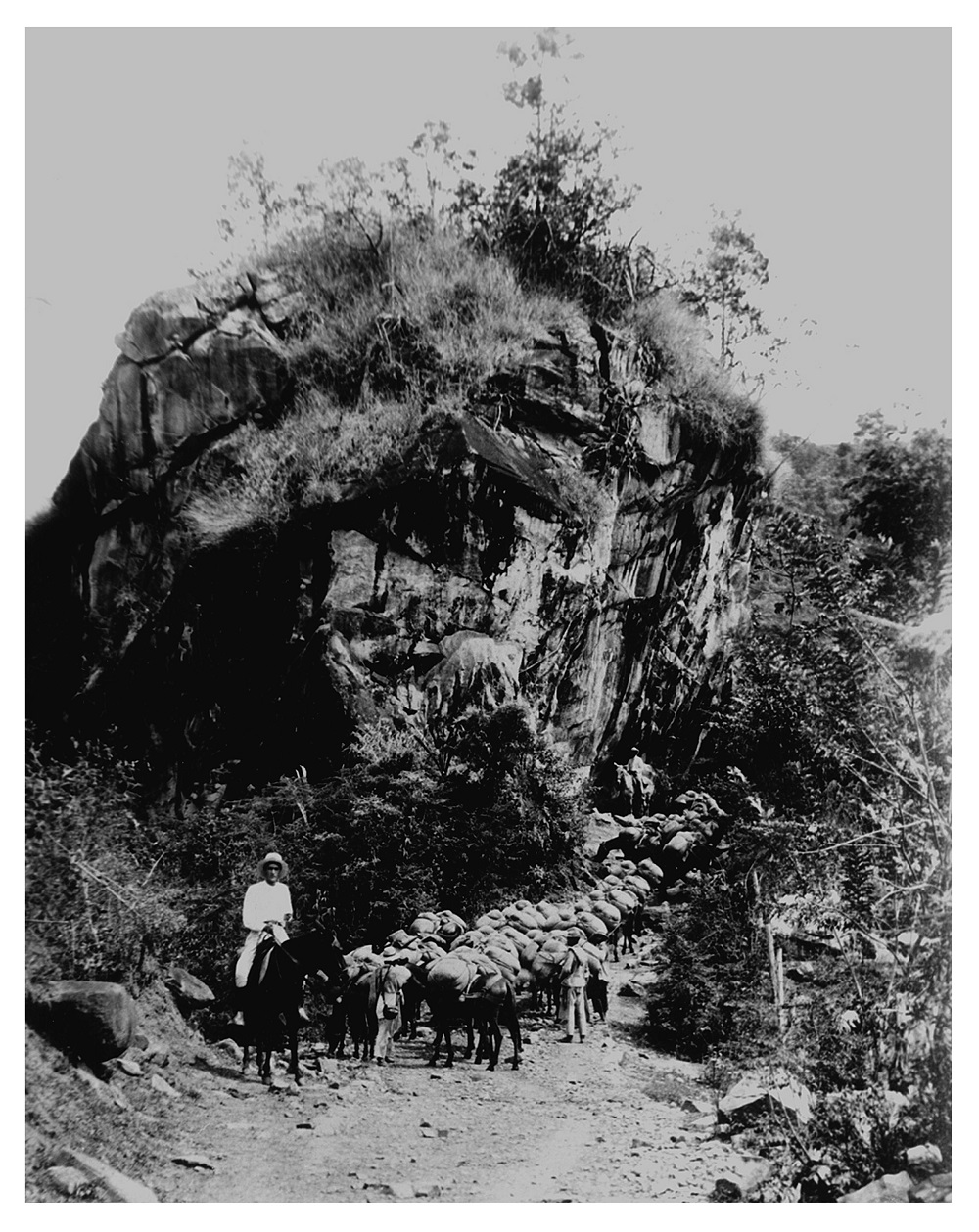

At the beginning of the century, coffee had already positioned itself as a basic product of the Colombian economy in the field of exports. The range of exported products was very limited: coffee represented almost 85% of exports, this fact weakened the Colombian foreign economy.

Germany, the United Kingdom and the United States were the main buyers of products exported by Colombia, but the United States represents the maximum percentage, reaching in certain periods, as in 1917, more than 80% of exports.

The development of the coffee sector has allowed the growth of the internal market and an improvement of the communication network that has favored a certain integration of the different regional markets.

However, geographical difficulties have created a transport system with little development of the internal market. in the country. Note that until the XNUMXth century, most transportation was by bridle paths, with designs being drawn without any technique, following the often impractical mountain ridges in winter.

We must also not forget the frequent use of human cargo ships, which are safer to transport other people.

World Crisis (1929-1945)

The macroeconomic performance of the first half of the 1950s was favored by high coffee prices, which favored the availability of resources and, consequently, the financing of sectors such as industry.

The subsequent collapse of coffee prices and the consequent lack of resources to finance industrial development led to the strengthening of protectionist measures such as those adopted years ago in the late XNUMXs and early XNUMXs.

However, the low diversification of the export base and the abundant evidence of excessive dependence on coffee for access to foreign exchange highlighted the need to initiate a process of export promotion.

Thus, on this occasion, the implemented protectionism was accompanied by measures to promote exports of non-traditional products, especially industrial products.

Thanks to this measure, during the second half of the 1950th century, GDP quadrupled. However, with respect to public spending, during the years 80-XNUMX, there were deficits followed by economic surpluses, which finally managed to exceed the level of surplus at the beginning of the period.

Likewise, the Colombian economy has maintained tolerable levels of inflation, being the highest 36% per year, in the early 1970s. Therefore, the strong impact of the economic recession of the 1980s that occurred in the region has not had completely direct consequences in Colombia, due to the influence of foreign exchange resources (mainly in dollars) from drug trafficking,

With which it has faced the situation, associated with the excellent general performance of the local industry, during this decade, the Colombian economy has maintained its growth at an average of 5% per year.

Since 1990

At the beginning of the 1990s, a new economic period began known as economic opening, which sought to insert the country into the process of economic globalization and within the framework of the Washington Consensus (1989).

The global recession, evidenced by globalization and the crisis in Asian countries, has wreaked havoc in Latin America and has seriously affected Colombia. Although the goal of reducing inflation from single digits to single digits has been achieved than unemployment rates, the loss of purchasing power.

The drop in production and the agricultural sector, reported by DANE for 1999, are very unfavorable, however, during the first three months of 2000, a reactivation of 6% of industrial production was estimated. In 2014, unemployment in Colombia was in the single digits.

So in 1998, the eradication of the unit of constant purchasing power and the fall of traditional exports, conditioned by the severe blow to the Asian economies during their crisis, made the performance of the time very poor.

And with this, the debt service had a contradictory result: it contracted, but the payment costs increased, which led to an increase in the perception of crisis, since the government did not have available resources. , had to resort to loans. external to deal with the situation.

In March 2000, the Banco de la Nación revealed that Colombia's external debt reached 36,000,000,000 USD, of which 24,490 million correspond to the public sector.

The total debt is equivalent to 41,3% of GDP, which, according to national and international analysts, "is worrying" and explains the increase in the severity of adjustments in the government's economic and fiscal policies since the beginning of the decade. Since 1990, Colombia has neglected import substitution and has opened new markets.

Economics in the Post-Conflict Era

One of the advantages of the peace agreements between the Juan Manuel Santos government and the FARC was the growth of tourism, taking into account a sustained growth in the rate of foreign visitors to the country, taking into account that in 2010.

Just at the beginning of President Santos' mandate there was a foreign exchange inflow of $3,440 billion, while for the year 2017 it generated an inflow of $5,49 billion, which is an increase of 68%.

In fact, the president-elect in 2018, Iván Duque Márquez, has stated that tourism can become Colombia's new oil given that hydrocarbon exports are $9 billion, while the Banco de la República forecasts exports of $ 7,000 million in tourism.

Economy of Colombia at a continental level

Colombia is the fourth largest economy in Latin America, but it is still far from the first places in terms of gross domestic product (GDP) per capita, which in 2015 reached 6.056 dollars. Argentina, Chile or Panama have more than double. And our country is approximately $2,000 below the average for Latin America and the Caribbean.

poverty and inequality

After the 1999 crisis, poverty in Colombia experienced a downward trend. The percentage of Colombians below the income poverty line fell from 50% in 2002 to 28% in 2013. The percentage of extremely poor people fell from 18% to 9% during the same period. Multidimensional poverty fell from 30% to 18% between 2010 and 2013.

Historical evolution of GDP per capita

Below we leave you the recorded and analyzed result of the historical evolution of the economy in Colombia, during each year, starting from the sixties:

| GDP per capita of Colombia in Dollars | |||

|---|---|---|---|

| Decade of 1960 (60 years) | |||

| Year | TAX ID No | GDP per Capita | Location |

| 1960 | USD 4.041 million | USD 245 | 16.480.383 inhabitants |

| 1961 | USD 4.553 million | USD 268 | 16.982.315 inhabitants |

| 1962 | USD 4.969 million | USD 284 | 17.500.171 inhabitants |

| 1963 | USD 4.839 million | USD 268 | 18.033.550 inhabitants |

| 1964 | USD 5.992 million | USD 322 | 18.581.974 inhabitants |

| 1965 | USD 5.790 million | USD 302 | 19.144.223 inhabitants |

| 1966 | USD 5.453 million | USD 276 | 19.721.462 inhabitants |

| 1967 | USD 5.727 million | USD 282 | 20.311.371 inhabitants |

| 1968 | USD 5.919 million | USD 283 | 20.905.059 inhabitants |

| 1969 | USD 6.405 million | USD 298 | 21.490.945 inhabitants |

| Decade of 1970 (70 years) | |||

| Year | TAX ID No | GDP per Capita | Location |

| 1970 | USD 7.198 million | USD 326 | 22.061.215 inhabitants |

| 1971 | USD 7.820 million | USD 346 | 22.611.986 inhabitants |

| 1972 | USD 8.671 million | USD 375 | 23.146.803 inhabitants |

| 1973 | USD 10.316 million | USD 436 | 23.674-504 inhabitants |

| 1974 | USD 12.370 million | USD 511 | 24.208.021 inhabitants |

| 1975 | USD 13.099 million | USD 529 | 24.756.973 inhabitants |

| 1976 | USD 15.341 million | USD 606 | 25.323.406 inhabitants |

| 1977 | USD 19.471 million | USD 752 | 25.905.127 inhabitants |

| 1978 | USD 23.264 million | USD 878 | 26.502.166 inhabitants |

| 1979 | USD 27.940 million | USD 1.031 | 27.113.512 inhabitants |

| Decade of 1980 (80 years) | |||

| Year | TAX ID No | GDP per Capita | Location |

| 1980 | USD 46.784 million | USD 1.645 | 28.447.000 inhabitants |

| 1981 | USD 50.969 million | USD 1.753 | 29.080.000 inhabitants |

| 1982 | USD 54.583 million | USD 1.837 | 29.718.000 inhabitants |

| 1983 | USD 54.249 million | USD 1.787 | 30.360.000 inhabitants |

| 1984 | USD 53.581 million | USD 1.728 | 31.004.000 inhabitants |

| 1985 | USD 48.877 million | USD 1.587 | 30.794.000 inhabitants |

| 1986 | USD 48.944 million | USD 1.557 | 31.433.000 inhabitants |

| 1987 | USD 50.948 million | USD 1.588 | 32.092.000 inhabitants |

| 1988 | USD 54.925 million | USD 1.676 | 32.764.000 inhabitants |

| 1989 | USD 55.384 million | USD 1.656 | 33.443.000 inhabitants |

| Decade of 1990 (90 years) | |||

| Year | TAX ID No | GDP per Capita | Location |

| 1990 | USD 56.412 million | USD 1.653 | 34.125.000 inhabitants |

| 1991 | USD 58.308 million | USD 1.674 | 34.834.000 inhabitants |

| 1992 | USD 68.997 million | USD 1.942 | 35.530.000 inhabitants |

| 1993 | USD 78.195 million | USD 2.160 | 36.208.000 inhabitants |

| 1994 | USD 98.260 million | USD 2.666 | 36.863.000 inhabitants |

| 1995 | USD 111.237 million | USD 2.967 | 37.490.000 inhabitants |

| 1996 | USD 116.838 million | USD 3.067 | 38.100.000 inhabitants |

| 1997 | USD 128.267 million | USD 3.323 | 38.600.000 inhabitants |

| 1998 | USD 118.442 million | USD 3.021 | 39.200.000 inhabitants |

| 1999 | USD 103.761 million | USD 2.614 | 39.700.000 inhabitants |

| Decade of 2000 (2000 years) | |||

| Year | TAX ID No | GDP per Capita | Location |

| 2000 | USD 99.875 million | USD 2.479 | 40.296.000 inhabitants |

| 2001 | USD 98.201 million | USD 2.406 | 40.814.000 inhabitants |

| 2002 | USD 97.946 million | USD 2.370 | 41.329.000 inhabitants |

| 2003 | USD 94.645 million | USD 2.262 | 41.849.000 inhabitants |

| 2004 | USD 117.092 million | USD 2.764 | 42.368.000 inhabitants |

| 2005 | USD 146.547 million | USD 3.417 | 42.889.000 inhabitants |

| 2006 | USD 162.766 million | USD 3.750 | 43.406.000 inhabitants |

| 2007 | USD 207.465 million | USD 4.723 | 43.927.000 inhabitants |

| 2008 | USD 244.302 million | USD 5.496 | 44.451.000 inhabitants |

| 2009 | USD 233.893 million | USD 5.200 | 44.979.000 inhabitants |

| Decade of 2010 (10 years) | |||

| Year | TAX ID No | GDP per Capita | Location |

| 2010 | USD 286.954 million | USD 6.305 | 45.510.000 inhabitants |

| 2011 | USD 335.437 million | USD 7.785 | 46.045.000 inhabitants |

| 2012 | USD 369.430 million | USD 7.931 | 46.582.000 inhabitants |

| 2013 | USD 380.170 million | USD 8.068 | 47.121.000 inhabitants |

| 2014 | USD 378.323 million | USD 7.938 | 47.662.000 inhabitants |

| 2015 | USD 291.530 million | USD 6.048 | 48.203.000 inhabitants |

| 2016 | USD 282.357 million | USD 5.803 | 48.653.000 inhabitants |

| 2017 | USD 309.191 million | USD 6.273 | 49.292.000 inhabitants |

| 2018 | $327 million | USD 6.562 | 49 887 000 inhabitants |

| 2019 | USD 355.163 million | USD 6645 | 49 974 090 inhabitants |

| Source International Monetary Fund IMF and World Bank BM (2019) | |||

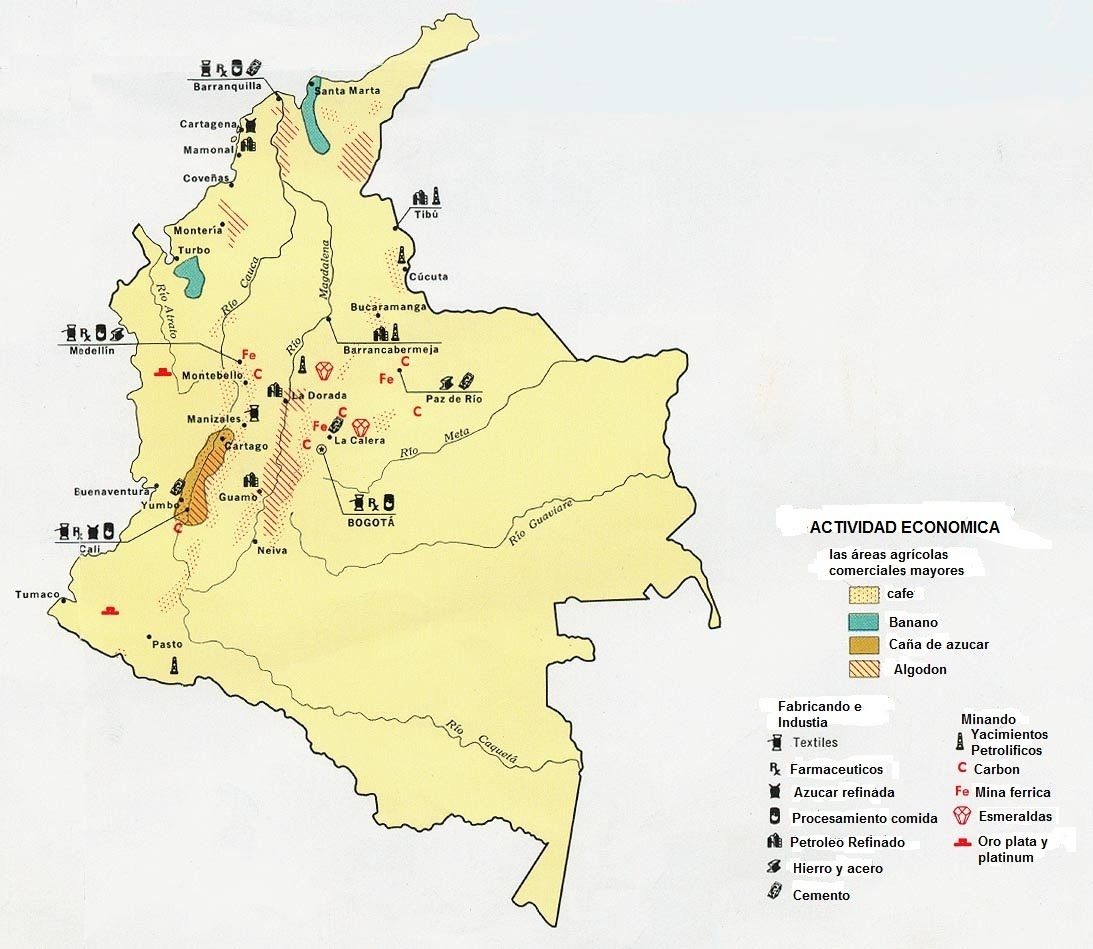

Economy by sectors

The Colombian economy is fundamentally based on the financial and real estate market, trade and manufacturing industries according to DANE.

Primary or agricultural sector

Next we will describe the different sectors of the agricultural economy:

Agriculture: it is regulated under the functions of the Ministry of Agriculture and Rural Development of the Colombian government, which plans the development of agriculture, where floriculture and banana cultivation occupy an important place.

Other elements evaluated show that, of all the land in the country, 10.3% was dedicated to forests, 7.3% to agriculture and 2.1% to other uses.

In 2013, the area dedicated to the main transition crops, such as beans or corn, increased by 1,0%, from 828.983 hectares to 837.304 between 2012 and 2013. The total production of transition crops was 4,9 million hectares. tons. including vegetables, which represents an increase of 9,7% over the previous year.

On the other hand, also in 2013, the area dedicated to permanent crops, such as coffee or sugar cane, was 1,4 million hectares, which represented an increase in production of 1,6% compared to until 2012, up to 5,2 million tons.

Café: One of the most traditional economic activities in Colombia is the cultivation of coffee, being the third largest producer in the world in 2014.

It has been a central element of the Colombian economy since the beginning of the XNUMXth century and has earned it international recognition thanks to the quality of the grain.

However, its importance and production have changed in recent years: in 2011, 7,8 million bags were produced, which represents a decrease of 12% compared to 2010.

But this last year between March 2017 and a production of 13,969 million bags were presented in February 2018.

The country exports around 560,000 tons per year, which is equivalent to around 85% of its production. Green coffee without caffeine represents 99.64% of total exports of this product. However, there are two other products: decaffeinated unroasted coffee and caffeine-free ground roasted coffee.

The United States, Germany and Japan are the main buyers of green coffee with 64% of Colombia's total exports, followed in order of importance by Canada, Belgium and Luxembourg, the Netherlands, France, Sweden, Spain, Italy and the United Kingdom. United.

Since 1927, the National Federation of Coffee Growers has technified and improved crops by selecting the qualities. It also regulated exports and defended prices in foreign markets.82

Recently, the Colombian economic authorities announced an upward modification of the projection of the behavior of the Gross Domestic Product (GDP), taking into account the behavior of the determining factors of the economy, such as the fall in unemployment, the recovery of the industry, the good consumption performance, among others.

However, the application of new economic measures has highlighted the integration of illegal activities in the economy in the calculation of the Colombian gross domestic product, according to the conclusion of a postgraduate work entitled «Money laundering in the Colombian formal economy: approaches on the impact on the departmental GDP”.

According to the author of the document, Second Lieutenant Luddy Marcela Roa Rojas, an officer of the Investigation Group for Asset Forfeiture and Money Laundering of the Directorate of Criminal Investigations and Interpol.

The conclusion was based on figures taken from DANE and the National Police, in particular with respect to the assets presented for asset forfeiture, which were seized from criminal organizations, or the seizure of money in the national currency.

These have been seen as demonstrative of the investment that criminal organizations make in money laundering and how they contaminate the economies of the departments.

"The contribution of Valle del Cauca, Antioquia, Cundinamarca, Amazonas and San Andrés, sectors traditionally marked by violence, was obvious," says Roa, who points out that Amazonas and San Andrés make a small contribution to the national GDP, but compare In the money laundering figures, this percentage is high.

The study provided by the National University Press Agency indicates that Antioquia is a region with a significant part of the GDP, it is also a dynamic economy marked by the presence of drug cartels and criminal organizations.

Regarding drug trafficking, the book The New Dimensions of Drug Trafficking in Colombia reveals how illegal trade and the different groups dedicated to drug trafficking have contributed to the construction of a nation with an underdeveloped field.

A pretty backward industry. and poor infrastructure, because the incoming resources did not take place in the modern economy but in the rural and informal world.

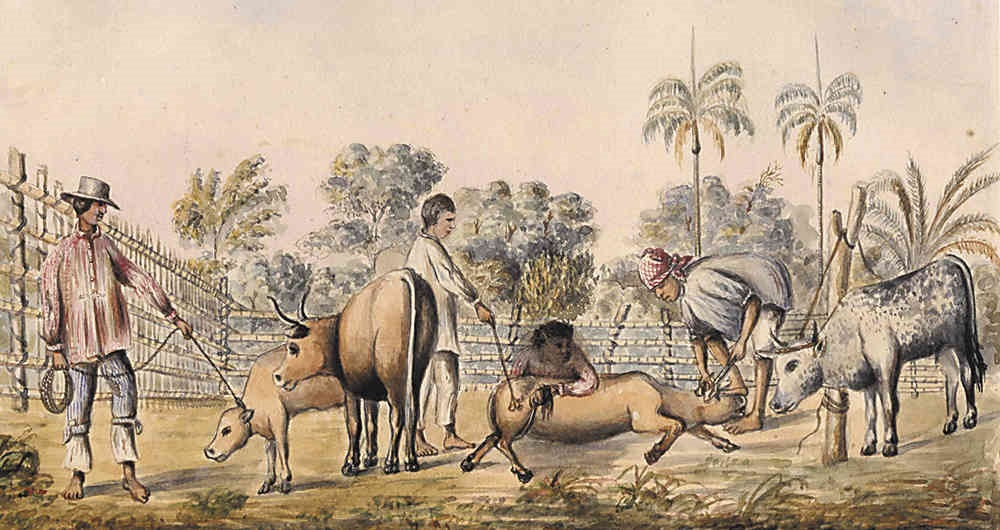

Cattle raising: exploitation and breeding of livestock is carried out on small farms and on large farms. Black and white, Casanareño, Costeño con horns, Romosinuano, Chino Santandereano and Hartón del Valle are the most productive Colombian breeds.

In 2013, cattle occupied 80% of the productive land in Colombia. The livestock sector is one of the most notable in regions such as the Caribbean region, where seven departments have livestock as their main vocation.

Also in Antioquia, where the largest cattle inventory in the country is located, the department had 11% of the cattle in Colombia that year 76, and according to the cattle inventory, in 2012 Antioquia had around 2,268,000 head of cattle.

Also in 2013, the Colombian cattle herd reached 20,1 million head of cattle, of which 2,5 million (12,5%) were dairy cows. In addition, the country's total milk production was 13,1 million liters.

In contrast, the increase in imports of meat from the pig sector, the high prices of inputs and the slowdown in the national economy caused a pig farming crisis in 2015.

Secondary sector

Industry: In recent years, Colombia has intensified its mining exploitation due to the use of new technologies and the arrival of foreign investors in the country. The textile, automotive, chemical and petrochemical industries stand out in the industrial sector.

Colombian oil production with almost one million barrels per day in 2012 makes it the fourth largest producer in Latin America and the sixth in the continent.

As for minerals, it is worth highlighting the exploitation of coal, whose figure reached 85 million tons in 2011, and the production and export of gold and emeralds. Natural gas production is estimated for 2011 at 9 billion cubic meters.

Third sector

Foreign trade: Production speculation is a concept applied by José Antonio Ocampo to explain the backwardness of the Colombian export industry compared to other similar productive sectors in other parts of the world, which, according to him, has hampered the ability to offer a product of uniform quality to the world market.

To this aspect, he adds that given the situation of changes in international prices and not favoring market conditions, this has led those responsible for the export system to simply abandon the production of a certain product and look for other points of sale for its capital.

Colombia's entry into the world economy has only favored those areas that have been able to take advantage of the alternatives offered by the market, developed from the colony. All this influenced the very important increase in its population, regional powers through political participation and the development of a nascent infrastructure, almost always in movement with its most important fluvial artery, the Magdalena.

On the other hand, Colombia has signed and put into force several free trade agreements within the framework of the economic opening policy; Among them, it is worth mentioning the Free Trade Agreement with the United States, the Free Trade Agreement with Canada, Mexico, the European Union, Japan, the Pacific Alliance, among others.

Shipping cost: is in this nation is formed by: air, land and sea. Quaternary sector: The main Colombian stock exchange is the Colombian Stock Exchange (BVC), a name given after the merger between the Bogotá, Medellín and Occidente stock exchanges.

Currency

The monetary unit of Colombia is the Colombian peso. Its symbol is COP, but it is not officially known and abbreviated as COL $. (Unlike the dollar, the Colombian peso sign is $ with two lines above the letter, not one.) The currency is issued and controlled by the Banco de la República de Colombia, a founded entity in charge of issuing, managing and controlling the monetary movements of Colombia, as well as the issuance of legal tender in the country, the peso.

The peso has been the currency of Colombia since 1810, when the real was replaced at an exchange rate of 1 peso = 8 reales. Currently, coins of fifty, one hundred, two hundred, five hundred and one thousand pesos circulate, while bank notes are one thousand, two thousand, five thousand, ten thousand, twenty thousand, fifty thousand and one hundred thousand pesos.

Other details Economic

Colombia is positioned as the fourth largest economy in Latin America, after Brazil, Mexico and Argentina, and in the international ranking it is among the 31 largest in the world. It is part of the CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa), which are made up of emerging economies with high development potential.

In 2012, the Colombia-United States Free Trade Agreement entered into force. The agreement joins the ten treaties already in force and the other six under negotiation.

Its economy is fundamentally based on the production of primary goods for export and for internal consumption, one of the most important economic activities is the cultivation of coffee, one of the most important world exporters of this product.

It has been a central part of the Colombian economy since the beginning of the XNUMXth century and has earned it international recognition thanks to the quality of the grain; However, its importance and production have decreased considerably in recent years.

Oil production is one of the most important in the continent, Colombia is the fourth largest producer in Latin America and the sixth in the entire continent.

Agriculture

Coffee is the main crop. After Brazil, Colombia is the third largest producer in the world and the first producer of sweet coffee. It is grown mainly on the slopes of the mountains between 914 and 1.828 m above sea level, particularly in the departments of Caldas, Antioquia, Cundinamarca, Norte de Santander, Tolima and Santander.

Other important crops are: cocoa, sugar cane, rice, plantain or plantain, tobacco, cotton, yucca, African palm, tropical and semi-tropical flowers. Some minor crops consist of grains, vegetables, and a wide variety of fruits. Plants that produce pita, henequen, and hemp are also grown, which are used to make rope and bags.

Fishing and forestry

Due to its geographical situation and with a great variety of fish species, Colombia has a great ichthyological wealth (ichthyology is the branch dedicated to the study of fish).

In the coastal waters and in many rivers and lakes of Colombia there is a great variety of fish, among which are: trout, tarpon, sailfish and tuna.

With regard to forestry, cultivation and maintenance of the mountains, we can say that the forests are found mainly in the Colombian Amazon, on the Pacific coast, in the Catatumbo area (bordering Venezuela) and in certain forest areas of the high basins and in the middle of the Magdalena and Cauca rivers. Most of the wood extracted in Colombia is obtained illegally.

Mining

Oil and gold are the main mineral products of this nation. Substantial amounts of other minerals are mined, including silver, emeralds, platinum, copper, nickel, coal, and natural gas.

The oil industry is under the control of a national company and several concessions to foreign capital. Crude oil exploitation is concentrated in the Magdalena River valley, some 645 km from the Caribbean Sea, and in the region between the Cordillera Oriental and Venezuela.

In Colombia there are several refineries, among which the one in Barrancabermeja stands out. In the Gulf of Morrosquillo (Coveñas) and Cartagena there are other very important ones.

Gold mining has been present since pre-Hispanic times and is carried out mainly in the department of Antioquia and, to a lesser extent, in the departments of Cauca, Caldas, Nariño, Tolima, (Quípama) and Chocó.

In our country, the increase in mining production is mainly due to the dynamics of coal mining. Coal production increased from 21.5 million tons to 85.8 million tons between 1990 and 2011, while the production of the rest of mining increased by 3.8 million tons during the same period.

What are the representative sectors of the Colombian economy

Basically, the economy of this country is based on the production of primary goods for export and products for consumption in the domestic market, the most traditional activity being coffee plantation.

Whose process is carried out in several regions of the country, highlighting the Coffee Region made up of the departments of Caldas, Risaralda, Valle del Cauca and Tolima.

In this sense, the quality of the grain, which has a careful harvesting and selection process, is recognized internationally, while it is the third largest coffee producer in the world.

Also, in the agricultural sector, the cultivation of flowers, tropical ornamentals, bananas, rice, bananas, cotton, cassava, beans, corn, sugar cane and other smaller crops such as grains, vegetables and a wide range are of great importance. of fruits

As for the livestock sector, concentrated in small and large farms in the departments of Antioquia, Córdoba, Casanare, Meta and Santander, it is one of the most notable in the Caribbean, which includes the breeding of indigenous breeds, such as white, black, Casanareño and coastal. with horns, Romosinuano, Chinese Santandereano and Hartón del Valle.

Other activities of the Colombian economy

The economy of the Colombian culture is also supported by the industrial sector, which includes the mining area with the extraction mainly of oil, gold, coal and other minerals such as silver, emerald, copper, nickel and natural gas.

Also highlight the textile, automotive, chemical and petrochemical industries and add other sectors, such as maritime, land or air transport, and finance.

At the same time, foreign trade constitutes the lame leg of the Colombian economy, due to the fact that to a large extent there is a difficulty in offering quality products that compete with the world market, on the other hand, some economists make sure that it is exported.

Oil and human talents, although they import Chinese products for local consumption, add to the repatriation of capital by multinational companies established in the country, however, the remittances sent by expatriates somehow compensate. this leak

Despite this, Colombia currently has free trade agreements that include the opening of markets for goods and services with Mexico, Mercosur, the Northern Triangle countries of Central America, the United States, Canada, the European Union and Japan, among others. , which have become the pillar of the consolidation of the Colombian economy.

Why are Colombian exports not growing?

Last year did not end well in terms of foreign trade. As reported by the National Administrative Department of Statistics (Dane), as of November 2019, the country had accumulated a trade deficit of US$10.283 million. The trend is worrying, because in the same period of 2018 the deficit reached only US$6.460 billion.

If we examine the numbers in detail, a significant increase of 61.9% in fuel imports appears in November.

This figure is explained by the higher demand for fuels since the growth rate has generally represented more vehicles, more air traffic and more mining activity. If fuel data is not taken into account, imports behaved as expected. In other words, the country imports what it really needs.

However, the behavior of exports, especially non-mining energy exports, still raises questions, as they do not seem to be answering. In November last year, the country's foreign sales fell by 13,6%.

There is a bias also marked by fuels, because during the first eleven months, they fell by 11,4%. However, agriculture did not progress, the manufacturing sector fell by 0.1% and other exports increased by 19.3%, but precisely those that participate the least in the total aggregate.

The question is crucial, because the external imbalance could represent the most important risk for the Colombian economy today: that the country does not have the currencies it needs. For now, external financing and foreign investment have filled this gap.

In other words, something must be done to improve Colombia's position in world trade. According to the Vice Minister of Foreign Trade, Laura Valdivieso, among other factors, the evident drop in the levels of foreign trade on the planet, caused by the trade war, has influenced.

The figures show this reality. In the first 10 months of 2018, imports from Europe and China increased by around 12%. And in the same period of 2019, Chinese imports fell by 5,1% and European imports by 0,7%.

Added to this is the drop in international commodity prices. During the same period in 2018, they fell to 14.9% and in 2019 they fell to 9.2%. This last fact has significantly affected the country, since Colombia's export offer is concentrated in primary products. The government has indicated three priorities to address this external deficit problem: better use of existing free trade agreements (FTAs), facilitating trade and stimulating foreign direct investment.

In addition, the government will launch the "Colombia Exports More" program in mid-February, to stimulate foreign sales, not only based on these political principles, but also with a regional orientation to expand the exportable supply of the departments.

Colombia needs to export more and more non-mining energy products. And it is clear that the country also has a great possibility on the services side, such as tourism. This sector is showing significant growth well above the world average. In fact, the tourism sector is expected to generate nearly $6 billion in revenue.

The country imported more fuel in November and exposed the risk of losing its energy self-sufficiency. If that happens, Colombia would have to spend $30 billion a year on this front. The Banco de la República recently indicated that the economic authorities had forecast a current account deficit of more than 4,5%.

When countries have permanent deficits above 5%, the adjustments to the economies are very drastic and include the possibility of recessions. In other words, the country would be on the verge of a very complicated situation on this issue.

As a gradual shift in the global energy basket looms, succeeding on this front is a matter of “care” for all of us.

Recover the passion for what is produced in the country

If the current situation leaves us with anything, it is the certainty that we are immensely more vulnerable than we think and would like to accept. Vulnerable as a human being and vulnerable as a society. Many buildings have disappeared or removed.

Traditions, rights, stories of years and years, institutions, in general, all human inventions have turned out to be as fleeting as any of our lives. Difficult but profound lesson we received.

The main assumption of this article is that the world, yes, is changing. Not only during this period, we don't know how long it will last. There are signs that there will be structural changes to which we must devote the greatest attention. The only thing that cannot happen to us is that we reach a new world and we have not prepared ourselves to face it.

We don't know how many things are reconfigured for this new world, but there are a few that we do know. We will have the highest unemployment rate in history, we will return to the levels of poverty that we thought we had overcome.

Businesses will go out of business, states will have higher levels of debt than previously considered acceptable, many will examine the previously considered megatrend of exponentially increasing travel.

We will be more digital every day, we will be able to work less in person, we will take more care of any version of the flu, health care systems will have a higher priority, we will consider ourselves more vulnerable to situations that we do not know about.

The perception and evaluation of risks, particularly in the financial field, will be completely re-evaluated. For example, is there a risk that international trade will change its patterns and that the path to full globalization will be interrupted? So it seems.

The idea, for many utopians, that the planet is a great productive unit, which must serve the entire population with the best use of available resources, seems that it will not be possible in the near future. Globalization, for many, has disappeared in the version we knew.

The above, for many reasons; It does not seem possible to think of global value chains, in which there seem to be commercial relations, on the one hand, and international political relations, on the other.

China's intention to dislodge the United States and Europe from the leadership position they have held for more than a century is clear. The latter's reaction to wanting to defend his position for a while is also clear. What incentive then will the powers of the West have to continue strengthening their main rival?

This new alignment between political, economic, and commercial interests is sure to lead to less dependency for many processes and products from countries, factories, and facilities that they established in countries like China.

In some cases, the relocation processes are already known, in others, the least we will see is a diversification that reduces dependency and, therefore, the risk of being in a country that is the great competitor of global dominance. In this scenario, Colombia probably has its main opportunity for several years. This is the opportunity to position yourself as an alternative for the next move.

Be part of the new value chains, probably now regional. Why can we be a good alternative for this? There are several reasons to think about our advantages. Geographic location, talent, skilled labor, strong institutions, democracy, and geopolitical affinity with Western powers. It will surely be a factor to take into account in this reconfiguration of new value chains.

However, the above will not be enough. This idea already has many, in Mexico, Peru, Chile, Argentina and other countries say the same. The competition for international investment, in countries affected by huge levels of unemployment, will be deadly.

The great competition comes from investment. Can we become the best destination for the relocation of investments? It will take a great strategic vision to achieve this, a great national decision. We will have to change some things, create others and resolve the obstacles and barriers that today do not make us the most attractive country for investment.

The agenda is known, what we do not know is to give the difficult debates. It is very difficult for us to undertake a deep and structural discussion of fiscal, labor, pension, tax, education, justice or competitiveness issues.

Can we have these debates and try to build a strategic development agenda that allows us to be winners in this ongoing reconfiguration?

An alternative is, if we don't want to give the whole debate, that we focus on creating the right conditions to at least provide the conditions that allow us to be competitive for new investments.

Create an attractive enough scenario for new investments, so that we can choose your destination. At least it offers what other countries offer. For example, through special economic zones or special regimes for new investments that create the jobs and development that we so badly need.

Another advantage of the reconfiguration of trade seems a little more radical in its intention to reduce international dependence, also seeking to favor products with a greater component of local labor, in a world where unemployment is one of the biggest problems.

It is expected that countries want to stimulate job creation in their territory, it is mandatory to do so. It is very important to try to export, but we cannot afford not to take advantage of our local markets to create more jobs.

For several years, many states in the American Union have been promoting campaigns such as Buy Local, including local, which aim to support companies that create jobs in the neighboring economy. It is legitimate to do so and it makes sense.

It is increasingly common to see consumers aware that what they are buying is the result of sustainable practices, products that comply with the law or products that create jobs in their environment.

From Andi, we have launched the decalogue of support for the national company, that is, all companies that create jobs in Colombia, regardless of the origin of their investment. It is important that there are more and more companies and jobs in our territory, we need them.

This is not about protectionism. In other words, it is not about putting barriers or taxes on imported products. It is about generating a strategy that allows more and more opportunities and jobs in the country.

Encourage consumers, companies and the Colombian state to use the power of choice so that with their actions they buy and generate jobs and well-being. But, in any case, we cannot allow any form of unfair competition from producers in other countries.

Unfair business practices are seen as a great affront by many countries, because they harm jobs, families, businesses and the state. The Decalogue also seeks to unite us in the defense and rescue of various companies and businesses.

The questions that the coronavirus is leaving us about the future of Colombia

With this pandemic, from an economic perspective, it has suspended all the terms of the system, at least for a significant part of the world's population. For the first time, a transnational scourge has left at least 50% of the world's population unable to earn money. This has led many authorities, governments and experts to run out of arguments or easy solutions.

The usual crises arise from financial, budgetary or external imbalances. In other words, by countries that have mismanaged their economies. But in this case, most of the inhabitants had to stay at home, companies had to turn off their machines and the production apparatus in general went into hibernation mode.

So governments need to square the circle: how can we make sure that the productive apparatus comes out unscathed if people stay locked up? In many ways, the coronavirus has learned clear lessons. The most recent crises have resulted in new institutions, risky decisions or simply adjustments that have structurally served to place economies at other levels.

For example, in the case of Colombia, the 1999 crisis highlighted the importance of having resources to guarantee public savings. As a result, the country decided to strengthen the Financial Institutions Guarantee Fund (Fogafin), today a solid entity that has very important resources for deposit insurance.

It currently has reserves of almost $20 million that support any crisis in the financial system. From this same crisis arises the current free exchange rate system, which showed its advantages in 2008 and 2014, years of violent external shocks.

The rules for fiscal adjustment in the regions, the fiscal rule itself and the new royalty framework come from situations in which crises have forced us to think of innovative, effective and realistic solutions.

But now everything is different. Apparently, no country on the planet had an institutional framework capable of dealing with a sudden stop in production.

In the current circumstances, other factors become important. For example, the possibility of guaranteeing income to a large part of the population without conditions. In other words, give (without euphemisms) money to people. Even the one that, before the pandemic, did not seem vulnerable.

Heading for the universal minimum income?

Clearly, the country has a strong social protection network that has helped secure the income of millions of people who benefit from programs such as Familias en Acción, Jovenes en Acción, and Colombia Mayor.

The government made the decision to pay 3 million families in these grants through the Solidarity Income program.

Roberto Angulo, an expert on public policy issues and currently a district councilor for social issues, explained that, thanks to the urgency of bringing income to a part of the population that until now was not on the radar of the government's social programs, he says:

“The platforms that have been opened complete what is needed to connect the lower deciles of the population. A technological barrier has been crossed,” she said. Thus, he explained, "we will be ready to have a guaranteed minimum national income."

This would be a step forward only in the Nordic countries. The concept of universal basic income began to develop strongly from the 1970s. And in recent years, authors such as Steven Pinker and Rutger Bergman have defended it.

The latter defends it in a provocative book called Utopia for realists. In short, it is about giving money to everyone without exception. With a simple principle: it is the best way to redistribute income. With the synchronization of databases, the need to advance VAT reimbursement, the desire to create solidarity income and the strengthening of programs by the Ministry of Social Prosperity, this path is open.

Environment to reform

Although the country recognizes the benefits of direct transfers to the population and admits progress towards a “universal basic income for Colombians” structure, the discussion that follows focuses on the income structure to finance this progress.

Finance Minister Alberto Carrasquilla raised the issue during the legislative discussion on the latest tax reform. If this institution is consolidated, it can move to a tax structure with a general value added tax. This will make it possible to fight fraud and strengthen public finances. This debate must remain open.

Keynes is right

The world always returns to the principles of one of the greatest economists of the XNUMXth century: John Maynard Keynes. This Englishman, who had a great impact on the global institutionality of postwar economic policies, was concerned to understand why an economic system based on freedom at a given time resulted in high unemployment.

We must not forget the effect of uncertainty in the future and how it affects people's investment decisions. Dudley Dillard, in his work on Keynesian thought, shows why someone has to think of the English economist every day and how classical economic thought is in serious trouble in a world dominated by uncertainty.

“In a world where the economic future is very uncertain and where money is an important means of accumulating wealth, the general level of employment depends on the relationship between the expected benefits of investment in capital assets and the price of interest that must be paid. to induce the rich to transfer ownership of their money. (…)

When confidence in the future is lacking and earnings projections are bleak, the price required for wealth holders to part with their money will exceed the expected rate of return. Investment and employment will fall to a low level.

A depression is a time when the premium to be paid on idle money exceeds the expected rate of return in raising new assets of almost all kinds.

This is one of the central problems that the authorities will face, since the end of the pandemic is not expected to result in an immediate economic reactivation, it remains to be seen how they are.

issue or not

The current economic discussion has at its center the idea of publishing it or not publishing it. In other words, "socialize" the public deficit resulting from the pandemic. The issue raises the question of whether bringing more money into the market could lead to higher inflation.

It all depends on what the government allocates to the issue resources and, secondly, what people spend that money they get from the state.

The central administration would allocate any emission resources to pay costs related to the pandemic: health, work and food. So far no one has discussed the issue in Colombia, but many economists are said to be in favor of doing so.

The other key question is what kind of recovery the economy will face. Here, the sensitive issue is the idea of the future of economic agents.

If the authorities do not show that they have all the means to deal with this virus or any other disease, the economy will suffer greatly. Building trust in public health policies can trigger a “V” recovery for victory.

What to invest in?

The pandemic has brought to light another aspect: the ability of countries to deal with pandemics will make a difference in these new times. Therefore, spending on health and research will be vital to reduce the impacts in these cases.

Therefore, the country faces a great challenge. Resources for the health sector are considerable, but it is clear that progress is still needed to make the country a center of research. It is not a distant goal.

An example of this is that of clinical studies: a 2016 document from the Pugatch Consulate for the Amgen laboratory indicates that Colombia could attract an investment of up to 500 million dollars to carry out clinical studies on new drugs or products. dedicated to health. There is definitely an opportunity.

The pandemic showed the first major planetary threat in history. It had a big impact. But that should not be an obstacle to seeing the lessons that can be learned. If you don't, the errors will reoccur in the future.

If you found this article on the Colombian Economy interesting, we invite you to enjoy these others: